Recharging the Global Economy: Dim Prospects for the European Economy

Business activity in the euro zone unexpectedly slowed this month, fueling concerns about Europe’s economic prospects and suggesting the European Central Bank will need to be more aggressive in cutting interest rates.

Article content

(Bloomberg) — Business activity in the euro zone unexpectedly fell this month, fueling concerns about Europe’s economic prospects and suggesting the European Central Bank will need to be more aggressive in cutting interest rates.

The euro fell to its lowest level since 2022 against the dollar after the purchasing managers’ gauge for service providers and manufacturers weakened. Political problems in Germany and France, as well as the threat of spending from the presidency of Donald Trump in the US, also weigh on the currency.

Advertisement 2

Article content

Here are some charts from Bloomberg this week on the latest developments in the global economy, markets and world politics:

In Europe

Business activity in the Eurozone unexpectedly fell in November, a sign of the damage caused by political turmoil and growing trade tensions. The euro fell to its weakest level since 2022 against the dollar as traders priced in an interest rate cut from the European Central Bank. The odds of a 50-point cut in December rose to 50%, up from about 15% at the end of Thursday.

Inflation in the UK rose above the October forecast to exceed the Bank of England’s target of 2%. Consumer inflation rose 2.3% from a year ago after a jump in energy bills. Services inflation – closely monitored by benchmarks for domestic stress indicators – remained above 5%.

The main gauge of euro-zone wages jumped by the most since the creation of the common currency in 1999 – complicating the ECB’s plans to cut interest rates as inflation soars. Negotiated earnings in the third quarter rose 5.4% from a year ago. That was up from 3.5% three months ago and was largely driven by Germany.

Article content

Advertisement 3

Article content

A dysfunctional stock market, a dysfunctional currency, a political system full of crises, a stagnant economy – that was the situation in Europe even before Donald Trump won the US election. Now, the continent is facing new trade charges against its biggest companies and investment outflows as Trump’s plans to cut taxes and gut regulations make US stocks more attractive. Add to that the growing anger over the upcoming German election and the escalating tensions with Russia and even the most optimistic investors are struggling to stay upbeat.

In Asia

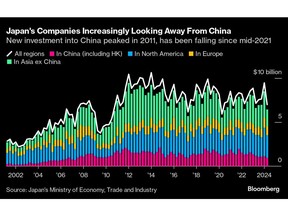

Japanese firms in China are growing increasingly pessimistic about the world’s second-largest economy, with nearly two-thirds saying it is getting worse and nearly half scaling back or halting their investments. About 64% of Japanese companies said China’s economy is worse than last year, according to a recent survey from the Japan Chamber of Commerce and Industry in China.

South Korea’s domestic debt grew by the most in three years last quarter, underscoring a development that kept the central bank from using policy until last month. Home loans, the largest component of debt, also rose sharply from the third quarter of 2021.

Advertisement 4

Article content

US & Canada

Housing starts fell in October at their slowest pace in three months as hurricanes boosted construction activity in general. Residential construction has struggled to gain momentum this year due to a growing number of new homes for sale and mortgage rates nearing 7%.

Trump’s vows to “frack, frack, frack” are about to collide with the global fracking that has finally reached record shale production.

Inflation in Canada rose more than forecast and underlying rate pressures accelerated again, setbacks that could prevent policymakers from making a second straight 50 basis point cut to interest rates next month. The first acceleration of headline inflation in five months could bolster the case for the Bank of Canada to cut borrowing costs more gradually, after officials increased the pace of tapering in October.

Emerging Markets

Years of runaway inflation are testing the visible limits of Turkey’s cash-intensive economy as the largest notes are increasingly insufficient to cover even daily expenses. The highest bill, 200 lira ($5.80), now represents more than 80% of all money in circulation, up from 16% in 2010, according to central bank data. After losing almost all of its purchasing power, each note is worth enough to buy two filter coffees at Starbucks.

Advertisement 5

Article content

Inflation in Mexico eased in early November while the economy continued to lose steam, giving the central bank room to cut interest rates for a fourth consecutive meeting next month.

The world

Ukraine’s military earlier this week carried out its first strike in a region bordering Russia using Western-supplied missiles as President Vladimir Putin approved a revised nuclear doctrine to expand the scope of using atomic weapons. The news sent investors scrambling for some of the world’s safest assets.

Iceland’s central bank accelerated its rate cut, while South Africa also cut rates. Indonesia’s central bank has warned that it is unlikely to lower them. Hungary, Angola, Paraguay and Egypt kept borrowing costs unchanged. Turkey also held back while suggesting that the cuts could be adjusted soon due to inflation.

—With assistance from Irina Anghel, Alice Atkins, Maya Averbuch, Taylan Bilgic, Kevin Crowley, Robert Jameson, Lucia Kassai, Sam Kim, Aliaksandr Kudrytski, James Mayger, Henry Meyer, Michael Msika, Tom Rees, Michael Sasso, Zoe Schneeweiss, Mark Schroers, Patrick Sykes, Randy Thanthong-Knight, Alex Vasquez and David Wethe.

Article content

Source link