US Consolidates New Russian Oil Sanctions to Weaken Putin Ahead of Trump

The Biden administration is weighing new, tougher sanctions against Russia’s lucrative oil trade, seeking to bolster the Kremlin’s war machine just weeks before Donald Trump returns to the White House.

Article content

(Bloomberg) — The Biden administration is weighing new, tougher sanctions against Russia’s lucrative oil trade, seeking to bolster the Kremlin’s war machine just weeks before Donald Trump returns to the White House.

Article content

Article content

Details of the potential measures were still being worked out, but President Joe Biden’s team was considering restrictions that could target Russian oil exports, according to people familiar with the matter who asked not to be identified discussing private discussions.

Advertisement 2

Article content

That move was something Biden had long resisted because of fears it could lead to higher energy costs, especially in the run-up to last month’s presidential election. But with oil prices falling amid a global glut and growing fears that Trump might want to force Ukraine into a quick deal with Russia to end its nearly three-year-old war, the Biden administration is now open to aggressive action, folks. said.

The talks highlight how much the Biden team is willing to risk dealing with Russia as it prepares to leave, especially with previous efforts to choke the Kremlin’s energy revenues yielding mixed results and average US gasoline prices hitting their lowest level since mid-2021. In its waning weeks, the administration has also moved military and financial support to Ukraine amid questions about Trump’s commitment to continued US support.

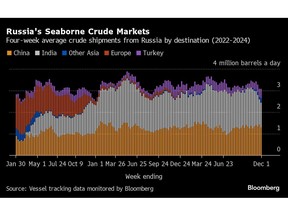

The United States has already banned Russian oil imports but new restrictions on imports from one of the world’s biggest producers – which could include the designation of foreign buyers of its crude – will improve a more than two-year policy put in place after Russia’s full-scale invasion of Ukraine. started in February 2022.

Article content

Advertisement 3

Article content

The administration was also weighing new sanctions against tankers used by Russia to transport its oil, the people said. New restrictions on the so-called shadow fleet could be introduced in the coming weeks, according to the people.

The European Union is planning similar measures against Russian shadow vessels before the end of the year. The bloc is expected to target people involved in trade.

A spokeswoman for the National Security Council and the Ministry of Finance declined to comment on Tuesday.

One model for broader US sanctions would be to impose similar restrictions on Iranian oil. If so, oil buyers face US sanctions. Such a move would be fraught with risk, as powerful countries including India and China are major buyers of Russian crude.

Soon, such restrictions could increase oil prices, causing economic difficulties around the world. Crude futures have lagged since mid-October, when Brent traded below $75 a barrel, compared with more than $120 in the months after the Russian attack.

Advertisement 4

Article content

It will also fuel tensions with adversaries and allies alike, whose help the US wants to limit shipments of sensitive goods such as chips and other technology that power Russia’s war machine.

While these moves will seek to benefit from a soft oil market, they will also be aimed at piling pressure on Russia before Trump takes office. The president-elect is pushing for talks to end the war in Ukraine, and current officials say they want to give President Volodymyr Zelenskiy’s government more power in the face of any talks.

With that in mind, squeezing President Vladimir Putin’s finances even more could strengthen Ukraine’s negotiating hand. There is a chance that Trump could reverse the measures if he feels he has raised oil prices, but that risks the potential political cost of looking weak or making concessions to Russia too soon.

Until now, Biden had limited restrictions on Russian oil in an effort to cap the price of the crude it sells, balancing the need to avoid global market volatility and limiting Russia’s income from consumers.

Advertisement 5

Article content

But while the price of offshore oil flows fell after the Group of Seven set the price as early as December 2022, it has rebounded.

The latest move will follow restrictions the US introduced last month on Gazprombank, Russia’s last major financial institution to be exempted from sanctions. Previously, the administration of Biden decided not to pay the bank sanctions, which European countries use to pay for the gas they still buy from Russia, for fear of creating chaos in the global commodity markets.

Already, Hungary, along with other countries that rely on Russian gas exports, have warned the US decision poses a risk to energy security. Turkey also demanded the lifting of sanctions.

—With assistance from Daniel Flatley, Alaric Nightingale and Julian Lee.

Article content

Source link