US Economy Surprised Again in 2024 Without Fed, Election Drama

Over the past few years, the US economy has been defying expectations for a slowdown, and 2024 was no different.

Article content

(Bloomberg) — Over the past few years, the U.S. economy has been falling short of recessionary expectations, and 2024 was no different.

Article content

Article content

Despite the uncertainty surrounding the presidential election, high interest rates and a sluggish labor market, economic growth has remained strong this year. The US will be the leading group among the seven countries, according to the International Monetary Fund.

Advertisement 2

Article content

However, the economy was far from perfect. Inflation appeared to be slowing down, leading the Federal Reserve to adopt a longer-term approach to interest rates. The housing and manufacturing industries continued to struggle under the high cost of borrowing, and consumers with credit card, mortgage and other debt saw delinquency rates rise.

Here’s a closer look at how the US economy performed this year:

Consumers Are Caught…

The answer to why the economy exceeded the expectations of the American consumer in 2024. Even as rents fell, wage growth continued to outpace inflation and household wealth reached new records, supporting continued increases in household spending.

Forecasters at Bloomberg Economics estimate that housing consumption will increase by 2.8% in 2024 – faster than in 2023 and almost double their projections at the start of the year.

…But Cracks Appeared…

Although consumers are still holding on, some of the main drivers of that remarkable strength have lost steam this year. Americans spent their money during the pandemic and often set aside a small portion of their income each month.

Article content

Advertisement 3

Article content

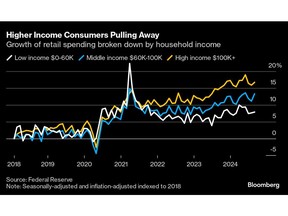

Consumer spending has also been increasingly driven by high earners enjoying the so-called wealth effect from gains in housing prices and the stock market. That comes as many low-income consumers rely on credit cards and other debt to support their spending habits, while others show signs of financial infiltration such as high crime rates.

…Including the Labor Market

Strong support for consumer spending also started flashing warning signs in 2024. Employment fell throughout the year and the unemployment rate rose sharply, giving rise to a popular indicator of recession. In addition, the number of job openings has decreased and the unemployed are increasingly finding it difficult to find new jobs.

Fed officials began cutting rates in September amid concerns that the job market could reach dangerous territory, though they have grown more optimistic in the final months of the year as the unemployment rate has stabilized at historically low levels. Wage growth, on the other hand, has remained stable at around 4%, which should continue to support household finances.

Advertisement 4

Article content

Inflationary progress has stalled

Progress towards the bank’s 2% inflation target has stalled in recent months following a sharp slowdown in 2023 and further progress in the first half of 2024. One of the Fed’s preferred inflation metrics — the price index for personal consumption expenditures excluding food and energy — rose. 2.8% in November from last year.

Although Fed officials chose to cut rates by a full percentage point this year in an effort to take pressure off the economy, Chairman Jerome Powell indicated that central banks need to see more progress in inflation before making further cuts in 2025.

High Rates Hurt the Housing Market…

The housing market continued to struggle under the weight of high borrowing costs. Borrowing costs, which fell to a two-year low in September, have rebounded to 7% on expectations that the Fed will take longer to cut. Contractors continued to offer incentives to attract buyers, including so-called mortgage purchases and payments on their behalf, as well as occasional price reductions.

While sales have stabilized somewhat this year, they remain below pre-pandemic levels. In the resale market – which is driving most home purchases – the National Association of Realtors expects the pace of sales in 2024 to slow significantly from last year, which is already the worst since 1995.

Advertisement 5

Article content

…And the Manufacturing Sector

The manufacturing sector has been another victim of high borrowing costs. Investment in new structures was hampered by high prices and weak demand abroad, and many firms cut jobs in an effort to save costs. Durable goods manufacturers have been cut from payrolls in all but one month this year.

President-elect Donald Trump’s economic agenda may also weigh on the sector in 2025. Although Trump has promised to boost domestic production, some economists and business groups expect that his plans to impose higher tariffs, deport millions of immigrants and cut taxes could increase inflation and depress the labor market, as well as disrupt supply chains. Capital spending by U.S. manufacturers appears set to rise at a faster pace next year amid that uncertainty.

Article content

Source link