China Faces Trump’s Return As Export Confidence Rises

China is facing a repeat of the tensions and uncertainty from Donald Trump’s first presidency, only with a weaker economy that relies more on imports than with the first trade war with the US.

Article content

(Bloomberg) — China is facing a repeat of the tensions and uncertainty from Donald Trump’s first presidency, only with a weaker economy that is more dependent on imports than during the first trade war with the US.

Article content

Article content

China’s trade record of more than 1 billion last year was equal to more than 5 percent of its gross domestic product, the highest level since 2015. Surpluses drove nearly a third of the increase last year, the most since 1997, according to the data released. last week.

Advertisement 2

Article content

That dependence on foreign markets adds to the complex set of challenges facing President Xi Jinping: persistent inflation, weak consumer demand, a shrinking supply chain and a currency under pressure. Bond yields indicate that markets expect the world’s No. 2 economy to weaken further.

To deal with those forces, Beijing is likely to continue to increase government borrowing this year to support its economic growth targets. But rising protectionism in the US and other major trading partners could threaten one of China’s most reliable sources of growth.

“The highlight of the economy last year was exports,” said Jacqueline Rong, chief economist for China at BNP Paribas SA. “That means the biggest problem this year will be American tariffs.”

BNP Paribas’ basic case is that Trump will impose 10% tariffs on Chinese goods, Rong said last week, although it is unclear whether the European Union and emerging markets will follow suit and increase trade barriers against China.

After winning the election in November, Trump said he would increase tariffs on all US imports from China by 10% on top of the tariffs already in place. At times, he has floated Chinese goods at even higher prices after taking office on Monday.

Article content

Advertisement 3

Article content

In response, companies rushed to raise funds, ramping up purchases from China in the final months of last year and likely driving demand this year. Chinese firms sent nearly $50 billion worth of goods to the US in December, the highest one-month amount since mid-2022. Calm may come next, as the Lunar New Year holiday will take place later this month.

Other Trade Diversifications

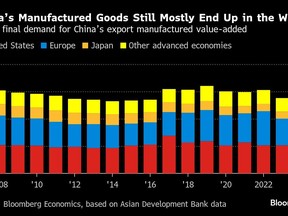

US tariffs over the past seven years have already pushed some companies to move their factories from China or elsewhere. American companies now directly buy less than 15% of Chinese goods, down from 19% at the end of 2017.

Despite hopes that some of this production will return to the US, most of it has gone to markets such as Vietnam, which is now receiving record shipments of Chinese electronic components to be assembled into products for export to the US and elsewhere.

China’s exports to Vietnam rose to a record last year, as did that country’s exports to the US. Ranked by bilateral trade balances, Vietnam’s trade surplus with the US is now the third largest, behind China and Mexico.

Advertisement 4

Article content

And while China’s direct exports to the US have declined slightly in importance over the past four years, the world’s largest economy remains the most important source of China’s final demand, buying more than half a trillion dollars worth of goods last year, equivalent to about 3% of China’s GDP. .

A new study from Bloomberg Economics confirms that although both nations report that they have diversified their trade with each other, the US continues to be the single largest value-added producer.

Penalties and taxes

If the US imposes new tariffs on China, Beijing can retaliate with its own tariffs, as it has done in the past. The government is also developing new tools to retaliate, as seen in the recent embargo on the export of some metals to the US and the sanctions against more than ten American defense companies last month.

“China’s efforts are going to be very strong” in export controls, said Alex Capri, author of Techno-Nationalism: How It’s Reshaping Trade, Geopolitics and Society. “The strong growth they see in 2024 despite US export controls may give them hope to lift their export controls and restrictions on imports of precious minerals, magnets, batteries and other goods.”

Advertisement 5

Article content

The Chinese government has been trying to buy fewer goods from the US and more from Brazil, Russia and other friendly countries, as part of a multi-year effort to diversify its trade relations, including signing trade agreements with Southeast Asian countries and creating trade agreements with Southeast Asian countries. the largest free site in the world. That reduced exposure to the US but could also make any retaliatory tariffs on US goods less effective than last time.

Chinese companies may try to redirect more goods to other markets to make up for lost sales in the US, but there is no guarantee that other countries will not impose their own tariff barriers if imports suddenly increase. South American countries have imposed duties on Chinese steel.

North American Tariffs

Trump’s return is prompting Mexico to act, with President Claudia Sheinbaum imposing tariffs aimed at reducing reliance on Chinese imports. He is trying to stop Trump from slapping a 25% import tariff on goods from Mexico.

Other nations taking early precautionary measures include Canada, which announced new tariffs on Chinese-made electric vehicles and steel in September. The European Union and Turkey have hit EVs made in China with tariffs.

In the end, Beijing’s most effective tool may be a long-overdue structural change: refocusing on the domestic economy and boosting local consumption to replace the demand lost in the new trade war with the US.

“Financial measures, which have been very conservative so far, can be very reasonable, especially the incentive payments to households to increase domestic consumption,” said Martin Chorzempa, senior director at the Peterson Institute for International Economics in Washington.

—Courtesy of Fran Wang and Yujing Liu.

Article content

Source link