December US Jobs Report Annual Average Employment

American employers may have scaled back their hiring last month to end a year of steady but healthy growth that economists expect to continue into 2025.

Article content

(Bloomberg) — U.S. employers likely cut their hiring last month to end a year of steady but healthy growth that economists expect to continue into 2025.

Article content

Article content

Payrolls increased by 160,000 in December, as the labor market rebounded from distortions caused by hurricanes and labor strikes in recent months, according to the median estimate of economists surveyed by Bloomberg. That would put average monthly job growth near 180,000 in 2024 — lower than three years ago but consistent with a strong labor market.

Advertisement 2

Article content

Monthly jobs data on Friday is unlikely to change Federal Reserve officials’ view that they may slow the pace of interest rate cuts amid a strong economy and slowly fading inflation. Investors on Wednesday will turn to the minutes of the Fed’s December meeting for more information on how upset policymakers were about the quarterly rate cuts. At the time, Cleveland Fed President Beth Hammack was the only dissenter.

Meanwhile, the unemployment rate is forecast to remain steady at 4.2% and average hourly earnings growth appears to have cooled slightly from a month earlier – consistent with the labor market no longer being a source of inflation.

A separate Labor Department report on Tuesday is forecast to show little change in November job openings from last month. The number of job vacancies is one million higher than it was at the end of 2019, and the average number of vacancies per unemployed person is in line with its pre-pandemic level.

What Bloomberg Economics says:

“The consensus on Wall Street is that economic diversification in the US will continue through 2025. Nonfarm payrolls will add fuel to the conversation. We expect the December headline print to be upbeat, with many sectors showing improved employment. Some of that could be a reversal from October’s weak, hurricane-affected print — something that won’t last. We also expect job openings to be stable, and jobless claims to remain low.”

Article content

Advertisement 3

Article content

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins, economists. For the full analysis, click here

A number of US central bankers will appear at public speaking events next week, including Fed governors Lisa Cook on Monday and Christopher Waller on Wednesday.

- For more, read Bloomberg Economics’ Full Week Ahead of the US

In Canada, December jobs data will be released after the unemployment rate rose to 6.8% last month. The trade report will show whether Canada’s economy remains world-deficient, despite the surplus with the US that is a source of irritation for President-elect Donald Trump.

Elsewhere, several major economies will release inflation data, with China likely to be near flat and the euro zone seeing a rise.

Below is our upcoming wrap on the global economy for the first full week of 2025.

In Asia

Inflation data will dominate, giving investors clues about future monetary policy moves.

On Wednesday, Australia is expected to report a slight increase in inflation – although much of the focus will be on the Bank of Australia’s preferred rate, which is likely to slip back to policymakers’ 2%-3% band.

Advertisement 4

Article content

On Thursday, China is likely to report that its CPI is close to falling in December while the PPI continues to contract, a sign that the government’s slew of stimulus measures have not done enough to boost demand. Thailand and the Philippines will also publish inflation figures later in the week.

India’s government will release estimates of economic growth for the current fiscal year on Tuesday, as concerns over weak consumer spending deepen. Industrial production data on Friday will give investors further clues about economic growth.

In Japan, data on Thursday will show wage growth.

- For more, read Bloomberg Economics’ Full Week Ahead in Asia

Europe, Middle East, Africa

Inflation will be a major theme across Europe this week. Data in the euro area on Tuesday may point to a slight acceleration in inflation in December, above the European Central Bank’s 2% target.

That reading, influenced by higher fuel prices, will come alongside numbers from Italy and after reports from France and Germany in the past 24 hours. Each of the three economies is expected to see rapid inflation.

Advertisement 5

Article content

The ECB’s estimate of consumer price expectations will be published on Tuesday. There are few scheduled public appearances by officials.

Elsewhere in the euro area, factory orders and industrial production will be released in Germany on Wednesday and Thursday respectively, each providing the latest glimpses into the poor health of manufacturing in the region’s largest economy. France and Spain will publish equal output numbers on Friday.

Inflation in Switzerland, scheduled for Tuesday, may show a further slowdown that could put pressure on policymakers to cut rates again this year. Economists are predicting a 0.6% result in December.

Inflation in Sweden – also seen as slowing – will be released the next day, while consumer price data from Norway and Denmark are due on Friday.

- For more, read the full Bloomberg Economics Week Ahead for EMEA

Two financial decisions are planned for the wider region:

- On Monday, Israel’s central bank will likely hold its base rate at 4.5%. Although growth has slowed due to the wars between Hamas and Hezbollah over the past year, inflation at 3.4% remains above the government’s target of 1-3%.

- On Wednesday, Tanzania may lower its rate from the current 6%, given that the 12% decline in the shilling against the dollar in the past three months may keep prices low.

Advertisement 6

Article content

Latin America

By the end of the week, the region’s central banks will have their final inflation targets for 2024 – and all but Peru will have missed their target again.

Colombia will likely see 19 months of inflation starting in March 2023, although consumer prices are unlikely to do more than a modest decline from 5.2%. In Mexico, too, consumer prices fell for the fourth of five months, from 4.55%.

In contrast, Chile’s consumer prices may have accelerated for the seventh month in nine, from 4.2%, while Brazil’s print is close to 5%, far from its 3% target, as the economy overheats.

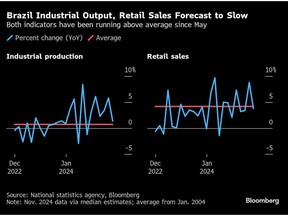

Brazil’s industrial production and retail sales have been running above trend since May, although November’s reading is expected to begin to decline under the weight of tighter financial conditions.

Peru’s central bank meets on Thursday and the first consensus call is for a quarterly cut, to 4.75%. Banxico and Banco Central de Chile are posting the minutes of their December meetings, with investors watching for any change in outlook or direction.

Chile at 5% is close to its forecast level of 4%, while Banxico at 10% appears to be 500 points shy of a first quarter 2027 maturity of 5%.

- For more, read Bloomberg Economics’ Full Week Ahead for Latin America

—With assistance from Monique Vanek, Nasreen Seria and Robert Jameson.

Article content

Source link