India’s Infosys, HCL Willing to Talk About Business Under Trump Presidency

Shares of major Indian IT outsourcing companies Infosys Ltd., HCL Technologies Ltd. and Wipro Ltd. got a boost from Donald Trump’s victory in the US election. They will have the opportunity to comment on how his presidency may affect their businesses when they pay their salaries.

Article content

(Bloomberg) — Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Article content

Article content

Shares of Indian IT outsourcing giants Infosys Ltd., HCL Technologies Ltd. and Wipro Ltd. got a boost from Donald Trump’s US election win. They will get a chance to comment on how his presidency might affect their businesses when they post earnings.

Advertisement 2

Article content

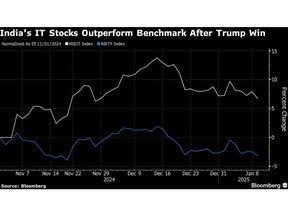

Overall, investors seem to be viewing the incumbents favorably in the sector, as the NSE Nifty IT Index has outperformed the broader market since the election. The tax cuts promised by the president-elect may cause businesses to increase technology spending. On the other hand, “America First” policies may not encourage outsourcing, which Indian companies rely on.

“Although the rate cut cycle has begun and uncertainty about the US presidential election has ended, their impact on the development of demand is likely to be seen at the beginning of the client budget cycle” in January-February, Nomura analysts said in a note.

US-listed peer Accenture Plc raised its earnings outlook last month pointing to a big move from the widespread adoption of manufacturing intelligence. Total employment in India’s IT sector also turned positive in the July-September quarter, analysts at PL Capital said, suggesting companies were gearing up for better order intake. Rival Tata Consultancy Services Ltd. on Thursday gave some hope for an increase in customer spending despite subpar profit estimates.

Article content

Advertisement 3

Article content

Avenue Supermarts Ltd. on Saturday reported a profit that missed estimates among competing e-commerce companies. The Indian retailer has also appointed Unilever veteran Anshul Asawa to replace CEO Ignatius Navil Noronha in February 2026.

In the east, Taiwan Semiconductor Manufacturing Co. it may also need to address country risks such as potential US tariffs or restrictions affecting its China business, Morgan Stanley said.

Country Garden Holdings Co. will post earnings for the full year of 2023 and the first half of 2024 after the delay. The beleaguered developer has previously proposed new terms with key banks to reduce debt and borrowing costs, aiming to reduce debt by as much as $11.6 billion. But a group of key bondholders, who own more than 30% of the company’s notes, have never been subject to restructuring terms.

Highlights to look out for:

Monday: HCL Technologies’ (HCLT IN) software business should have strong sequential growth as the IT business suffers from seasonality. Analysts at Nuvama expect the company to improve its full-year services revenue forecast to 4% to 5%, from 3.5% to 5% previously.

Advertisement 4

Article content

Tuesday: Country Garden (2007 HK) is likely to record another loss for the delayed 2023 full year. It has reached an understanding with the coordination committee, which includes seven banks that are long-term business partners of the group for the restructuring. The embattled developer is counting on a turnaround in sales to reassure borrowers, though it also expects fewer housing completions this year.

Thursday: Infosys’ ( INFO IN ) recurring revenue growth is likely to reach 6.3% thanks to the financial services segment, which saw better discretionary spending, Bloomberg Intelligence said. A slightly negative impact from seasonal furloughs could help margins grow from last year. Moneycontrol reported that the company has postponed the annual salary increase until the January-March quarter. PL Capital expects Infosys to slightly raise its full-year revenue guidance.

- TSMC’s (2330 TT) fourth-quarter revenue is up nearly 55%, estimates show, as demand for its N3 and N5 AI facilities and smartphone production remains strong. It previously saw a 39% rise in October-December revenue, driven by strong demand for AI hardware. The semiconductor giant may offer conservative guidance for its 2025 sales growth and may overdeliver later, Morgan Stanley said.

- Reliance Industries’ (RELIANCE IN) quarterly profit should rise 8.9% boosted by telecom unit Jio’s price hike. Refinement margins should improve sequentially, say PL Capital analysts, amid rising product fragmentation. Any comments from the company regarding the new set of US sanctions against the Russian energy industry are eagerly awaited. Watch for comments related to its streaming services business, as its Disney JV was terminated last quarter.

Friday: Wipro (WPRO IN) is expected to post slightly changed earnings due to weakness in the Americas and furloughs. The focus will be on the strategic plans of Wipro’s new management, say analysts at Motilal Oswal.

- Tech Mahindra’s (TECHM IN) third quarter profit almost more than doubled due to cost initiatives. Revenue growth may have been held back by continued weakness in telecoms, Elara Capital said in a report.

—Courtesy of Charlotte Yang.

(Updates throughout.)

Article content

Source link