US Inflation Data to Remain Strong, Feeds Fears of Higher Rates

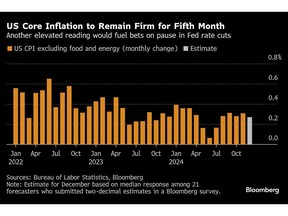

Forecasters expect the monthly report on US consumer prices to show a fifth month of strong increases, strengthening the case for a temporary suspension of interest rate cuts by the Federal Reserve.

Article content

(Bloomberg) – Forecasters expect the monthly US consumer prices report to show a fifth month of strong increases, bolstering the case for a temporary pause in interest rate cuts by the Federal Reserve.

Article content

Article content

The so-called core consumer price index, which excludes food and energy, was seen rising 0.3% in December and a 0.4% improvement in the overall index, according to average estimates in a Bloomberg survey. The CPI report is scheduled to be published on Wednesday by the Bureau of Labor Statistics.

Advertisement 2

Article content

Wednesday’s figures come at a critical time for investors and policymakers, with the 10-year Treasury yield ticking up more than half a percent amid renewed inflation fears since last month’s CPI release in Dec. 11. And the median expectation of a 0.3% increase in the core rate hides a contentious split among forecasters, with 39 in a Bloomberg survey on the horizon. and 32 showing a positive increase of 0.2%.

“The December CPI report may raise concerns that progress on inflation has stalled,” Bloomberg economists Anna Wong and Chris G. Collins said in a preview of the January 14 numbers. “Market discussions are focused on whether the 10-year Treasury yield can break 5%. The combination of the strong CPI print and the other big data we expect this week suggests that is indeed possible.”

Here are the key parts to look for in the report:

Rents

The two most important components of the CPI – owner-occupied rents and primary residence rents – rose in November at the slowest pace since the start of 2021, giving hope that the long-awaited decline has begun. The numbers have been fluctuating throughout 2024, and many analysts have penciled in a somewhat higher reading for December, but the magnitude may ultimately determine where the broad backbone index lands.

Article content

Advertisement 3

Article content

“We expect both rental housing and OER to accelerate, but remain below current trends this year,” economists at Morgan Stanley led by Diego Anzoategui said in a January 8 note previewing the report. “It is not our model forecast, but the December CPI print could reach 0.2%. Weak increases in rent or car insurance could easily move the core CPI below 0.25%.

Walking

Categories associated with travel – such as lodging away from home, airfare and meals away from home – are generally considered proxies for basic consumer demand and have generally experienced strong price increases in recent months.

Analysts were divided on the outlook for hotel prices especially after accommodation outside the domestic category rose 3.2% in November, the fastest monthly pace in two years. Some expect a complete decline in December while others, such as Pantheon Macroeconomics Chief US Economist, Samuel Tombs, are writing for another strong increase.

“Record travel peaked during the holidays; December air passenger numbers were 10% above their 2019 level,” Tombs said in a January 14 letter. , according to data from STR Inc.”

Advertisement 4

Article content

Furniture

Following the fall in foreign prices in late 2023, the pace of inflation in goods such as food, energy and used cars and trucks – so-called “core goods” – will decrease in 2024. In November, they increased by 0.1%, thanks mainly to a 0.7% increase in household goods and services.

Fed officials will likely look to key assets for clues about inflation amid concerns about the impact of the Trump administration’s policy proposals, according to Skanda Amarnath, executive director of Employ America.

“To the extent that tax uncertainty is reflected in expected behavior, it appears that price increases have come ahead of policy announcements,” Amarnath said in a Jan. 13 note. “If key assets from November rebound, we will be more cautious about further devaluations.”

Article content

Source link