Boe to bring back restaurants by predicting ‘fullness’

The bank of England is expected to face Rachel to reduce its view of the October’s budget Charkhevis.

Content of article

(Bloom Modget) is expected that the English bank is expected to return this week by reducing its viewpoint and the budget Charks will add Exchequer to reveal a major economic growth package.

Content of article

Content of article

While the UK Central Bank is expected to provide assistance by cutting down the price of the third time since August on Thursday, its new predictions may be to strengthen the UK in Stagflowi.

Advertisement 2

Content of article

Those who are closely examined by Bloomberg is expecting a booe to reduce the quarter points to 4.5%, the eighth level financial policy are expected to continue with the “slow processing” policy in the system. Catherine Mann, a foreign member, is expected to vote for lending costs unchanged.

“It is clear that growth in material weaknesses, which means that the MPC will probably reduce its growth of this year,” said Thomas Pugh, economic scholar Rsm. “However, inflationary pressures are now up again.” He foretells the full amount of cuts of fours this year in 3.75%, while markets are sold three.

The BOE is held at a place between the US, where strong growth and inflationary growth is forcing the reduction of digestion, and the European bank rates, where European values are used for the fifth.

“The bank in its coming goal is to deal with inflation and growth growth,” said Mat Swannell, a senior economic adviser in the Alece Club in the interview.

Content of article

Advertisement 3

Content of article

On the front of the Boe’s decision, the item club has reduced the UK development prediction of 2025 to 1% from 1.5%, according to a published report on Monday. Inflation seems to be left above 2% of the 2% target in the next 12 months, in addition to the Warning that the UK rebels.

“The UK lost pressure at the end of 2024 to leave a larger hill and climbed to achieve 2025,” Uswannell said. Business investment, an integral part of the labor process, will take possession. The EY prepared its investment for investing growth in 2% from 3% between economic uncertainties, lending prices and government tax rate.

Last week, Reeves announced the planning and converting changes and provides a green light on infrastructure projects including a third contrary rungay at HEATHROW in the development of growth.

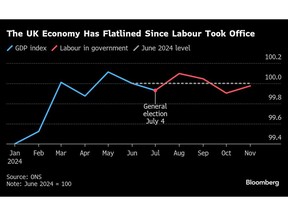

Growth will be “the first time of another,” he said as he wanted to eliminate the bright narrative of the first six months and answered after fighting tax rates. The economy focused since the work won the general election in July.

Ad 4

Content of article

Besides the expected measure to be cut, the February Maboe Policy Report is almost impossible to provide a lot of support. It will renew its labor ‘£ 26 billion test ($ 32.4 billion) tax payment for employers. BRUNA Skarica, UK economicist in Morgan Stanley, says recent evidence raising firms that will exceed any more prices in NOE.

That, alongside high price and energy prices, it may notice that boe increases its image infilation in the first part of this year by 0.3-0.4 percent. The Bank of America The Economist believes that Iboe will review its growth predictions in both short and long term “to indicate the latest weakness, weak confidence, and higher bankruptcy. In November, Boe was foretold 1.5% of growth this year. Agreement now is 1.3%.

The Building of Revenue Market Program Assurance Building and Predictive growth threatening threatening to integrate contact on Thursday. The markets were herself three quarters this year on Friday but the bank’s prediction is probably closed when two were completely removed. Both are less than four times to cut bank predictions and emperor Andrew Bailey effectively permitted.

Advertisement 5

Content of article

The American Economists say that the MPC can “sign the full pushback against the market prices” by showing inflation for its higher or three years’ period. However, that can mean predicting bank growth, which is also a market method, looking at real hopes in the UK, to reduce Chancellor’s unnecessary chantsllor.

A former US Federal Reserve’s chairman Bernanke said the bank should consider using its prices instead, because the risk of current meetings “receive the translation of that committee trying to say.” The Boe is planning to use “conditions” instead.

Content of article

Source link