Dollar bears catch in the vomiting of US kicks

President Donald Trump is facing threats and raised a dollar last week, but the growing dollar group bets the Greenback Affing Signs and the trading of the trading war will calm down.

Article content

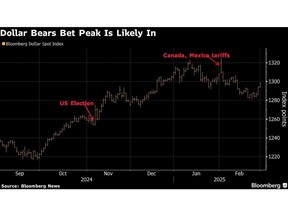

(Bloomberg) — President Donald Trump’s tariff threats once again lifted the dollar last week, but a growing group of investors is betting against the greenback amid signs the US economy is cooling and on concern a trade war will weaken it further.

Article content

Article content

The expanding chorus of greenback bears includes asset managers Invesco and Columbia Threadneedle and hedge fund Mount Lucas Management. On Wall Street, Morgan Stanley and Societe Generale are warning clients that going long the dollar is an overcrowded trade that may not hold up.

Advertisement 2

Content of article

They look forward to passing women daily diverted tax announcements, and as they saw it, the narration around the Greenback is only black. Instead of receiving support from the implementation of inflation and maintained high inflation and storage rates, now be concerned that all uncertainty is reflected on the risks you display.

The result is what market expectations of the Federal Delivery of the Federal Society and the US Economy Based a 7.1% of the DIFMING query as investors and international costs and violated the peace agreement between Russia and Ukraine.

“I don’t think you can send a very high dollar, because it is very expensive,” said Kit Juckets, the Head of Socgen’s London. “But can he send it down? He definitely can, if he hurts the US economy.”

Market risk

The worldwide record is now about 2% under the post of the election when it reaches it before Trump, during the risk of approaching shares and treasury treasures.

Content of article

Advertisement 3

Content of article

Last week he chased the risk of traveling short distance in the current location. Greenback is combined on Thursday, combining its decline in February, after Trump, after 25% of Canada and Canada will take March 4%.

The US Currency Extended Gains on Friday in the Affiday of a Headermath of a Headske Between President trump and Ukrainkiy, Leading to the Collapse, Leading to the Collapse, a Potential Deal on Critical Minerals. In a conversation after breaking Oval Office, Scott’s Scott’s SCOT (Secretary of Scott and taxes may also produce income.

Wrath

Tax articles have allowed the dollar because they often speak to the expense, damage the need for those assets and reduce the demand for money to buy them.

At the same time, investors received a reminder last week that the economic back, as the domestic sale is organized in the lower and unemployment of the highest claims.

Ad 4

Content of article

That is the background with bears convinced that they rely on the right place.

“Some time the market has only prices on the good side of the” Management Policy, David Aspell, an investment manager in Mount Lucas, had $ 1.7 billion under managers. “And you need to do perfect things that try to do so will be fine.”

This bag is short of the peers Vers Versis including a pound and a Mexican peso as the election election over the increase.

Invesco, currently full of dollars from the overview of the past few weeks in Europe’s best European details.

Columbia Threadeneedle, Ed al-Hussaiiny says he wished a dollar against the market fees from December. When the shape of bullish-dollar rises after the feeding signs the speedy, his thought is that he may not be able to get a lot of trading. Rates Strategistist said it arranged to keep a short position at least six months.

The US finance deduction from the latest top reminds the Morgan Stanley Stanley Strategelects First of TRUMP NAME 2017. At that time, the cheap amount after taking the meeting followed his conquest of its election.

Advertisement 5

Content of article

Bonds too

Feeling change is exploding in cash market. Traders withdraw two years of being over the lowest of October as expected to form deep decrease.

Low break receives symptoms of economic weaknesses “Dollar Lear’s case,” said George Catrambone, the DWS americas. “Realous dolphery you need to see the market price in more cutting, but eventually depends on what other main banks do.”

Currently, merchants see about 0.7 percent of a yearly degree.

Whether the difference helps to explain why the market, everything, is still the value of glittering power. In the future, for example, pheratators such as Hedge Funds are still dependent on receiving dollars even after a decline in low-down betting.

But unknown, Of course, the price prices will play.

Goldman Sachs Group Inc. They are waiting for many dollars to say that the LEAST levies eventually last, and he said on Wednes that the market supported that crime. At that time, Morgan Stanley, opposed last week that dollars were deeply sensitive to the tax announcements in the weeks new passed, which could even add a dance slide.

Ad 6

Content of article

Investors, deal with them, and they do not seem to see the expiry of the fees sooner.

“Variation may increase, but it was not clear to me that the American Dollar comes out winning,” said Alesio de Longis in Invesco.

What should you watch

- Economic information:

- March 3: S & P Global US Reffumeld PMI; expenditure; Production and prices are paid; New orders and work

- March 5: MBA loan requests; ADP employment change; S & P Global Services US Global US and Comite PMIS; orders of strong and strong goods; Ism services indicator; The Federal Reserve Book

- March 6: Commercial Balance; First and ongoing claims without work; Wholesale Veeries

- March 7: Change for unpaid payments; rate of unemployment; Average hourly hour

- Fourth Calendar:

- March 3: Ust. Louis Fends Movember Alberto Zoklem

- March 4: New York New President Footed John Williams

- March 6: Atlanta Fed President Raphael Bostic; The emperor is a joke; Biladelphia Fed President Patrick Harker

- March 7: Seated seat Jerome Powell talks about the economy. Williams; The Ruler who has read Michelle Bowman; Emperor of Fed Governer Adriana in Glor

- March 8: Dark Time Sofed begins

- Calendar of auction:

- March 3: 13-, 26-stoel Bill

- March 4: 6-Sound Bill, 12-Day CMB

- March 5: 17-week of Week

- March 6: 4-, debts of 8 weeks

-In help from Michael Mackenzie.

Content of article

Source link